Developing Egypt's Sulfuric Acid Industry

AK Tyagi, Nuberg, India, explains the contributing factors that are influencing the current conditions of the sulfuric acid market, and examines the development of a sulfuric acid plant in Egypt.

World Fertilizer, May/June 2023

The worldwide sulfuric acid market has been steadily growing as one of the primary suppliers of raw materials for various chemical and industrial applications. The fertilizer industry is also driving market expansion. Major sulfuric acid suppliers across the world are projected to enhance their already booming exports in the near future as worldwide demand for sulfuric acid continues to grow.

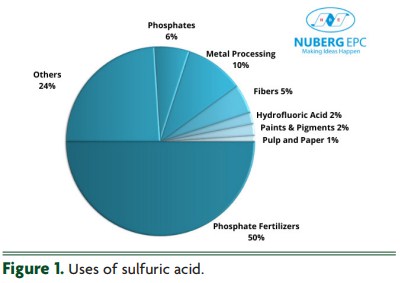

Sulfuric acid is one of the global chemical industries’ most important molecules and products. So far, the majority has been utilised to manufacture various types of fertilizers. Sulfuric acid is also in high demand in other chemical and industrial areas, such as metal processing, pigment, petroleum, paper and pulp (Figure 1). China is currently the world’s greatest producer of sulfuric acid, whereas Canada is the world’s largest exporter.

Grand View Research’s (GVR) industry analysis reveals that the global sulfuric acid market was worth US$10.1 billion in 2016, and is predicted to grow to US$13.45 billion by 2025, reflecting a robust compound annual growth rate (CAGR) of 3.3%.1 The market is predicted to be driven primarily by rising phosphate fertilizer production capacity and tightening environmental rules to regulate emissions, which will lead to increased use of smelters to capture sulfur dioxide products.

According to GVR, the global market is predicted to grow due to rising demand for the product from the fertilizer, chemical manufacturing, paper and pulp, petroleum refinery, metal processing and automotive industries for use as a catalyst, dehydrating agent and reactant. Increasing concerns in the agricultural sector about high crop yields and food quality are expected to further drive the fertilizer industry’s expansion, which will likely aid the growth of the sulfuric acid market.

Government controls, high raw material costs, reduced sales due to surplus and health concerns about sulfuric acid are some of the factors limiting the industry.

The future of Sulfuric Acid

The fertilizer segment was the largest consumer of sulfuric acid in 2016 due to its use as a raw ingredient in the production of phosphate fertilizers. Between 2022 – 2027, the worldwide sulfuric acid market is expected to grow at a rate of more than 3.5%.2 Asia-Pacific is predicted to capture a significant

revenue share of the sulfuric acid market in the coming years, with a high CAGR. Increased foreign investment, a flourishing agricultural sector with a large population base and an increasing preference for sulfuric acid in various chemical and fertilizer processes in expanding countries, like India and China, are all contributing to this expansion.

revenue share of the sulfuric acid market in the coming years, with a high CAGR. Increased foreign investment, a flourishing agricultural sector with a large population base and an increasing preference for sulfuric acid in various chemical and fertilizer processes in expanding countries, like India and China, are all contributing to this expansion.

During the projected period, the fertilizer sector is expected to lead the sulfuric acid market in terms of application. Because the world’s population is growing, there is a greater demand for higher-quality food crops. Farmers employ chemicals such as fertilizers to boost agricultural yields as hectares of arable land shrink, owing to rapid industrialisation and urbanisation. As a result, the fertilizer section of the sulfuric acid market is likely to grow during the forecast period due to increased use of sulfuric acid in fertilizer manufacturing.

In terms of value, China is the largest market in the Asia-Pacific region, accounting for a significant portion of the market. The sulfuric acid market in this region is being driven by a thriving chemical industry, cheap availability of raw materials and increased development strategies, such as the establishment of production facilities to fulfil the growing demand for sulfuric acid. Due to the wide range of uses for sulfuric acid, the market is expected to remain stable and sustainable.

Fertilizers

Sulfuric acid is used to make phosphate fertilizers such as superphosphate of lime and ammonium

sulfate, which contain 50 – 60% sulfur. In the manufacturing of all high-grade phosphate fertilizers, phosphoric acid is generated as an intermediate product. Phosphate fertilizers are essential for root formation and growth, as well as for boosting the quality of fruit and vegetable crops. They are also critical for seed formation, water conservation and helping to expedite maturity.

sulfate, which contain 50 – 60% sulfur. In the manufacturing of all high-grade phosphate fertilizers, phosphoric acid is generated as an intermediate product. Phosphate fertilizers are essential for root formation and growth, as well as for boosting the quality of fruit and vegetable crops. They are also critical for seed formation, water conservation and helping to expedite maturity.

Case study: Sulfuric Acid Plant in Egypt

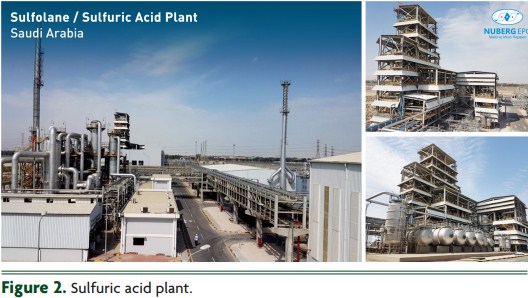

Nuberg EPC has been awarded contracts to comission multiple sulfuric acid plants (Figure 2), including one for Sprea Misr in Egypt. This case study details the learnings and obstacles encountered throughout the process.

- Client name: Sprea Misr.

- Location: Sprea Misr, Ramadan, Egypt.

- Plant capacity - Plant capacity.

Project details

Sprea Misr, a renowned chemicals and plastics manufacturer in Ramadan, Egypt, awarded the project. The project is now in progress, and Nuberg is the single-point solution company in charge of the project from conception to commissioning.

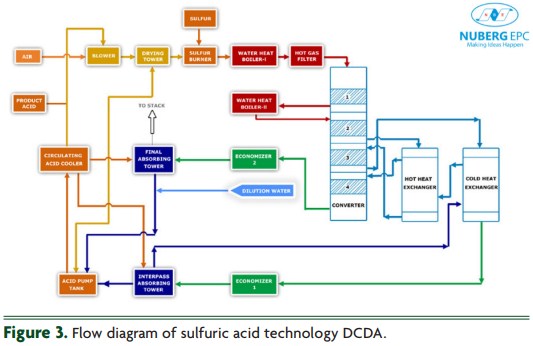

The 500 tpd sulfuric acid plant project is based on the latest Double Contact Double Absorption (DCDA) process technology.

The double contact process is used for the production of sulfuric acid in high concentrations which is required for industrial purposes (Figure 3). A 5 MW turbine and a steam-based power generation facility with a complete bypass system are also included in the project. This is the first time that the company has built a turbine unit for electricity production. The agricultural sector will recieve the sulfuric acid produced in the plant, which will be used to make urea and other fertilizers.

Equipment and machinery

The scope of the work includes the engineering, procurement and construction (EPC) and lump sum turnkey (LSTK) of a 500 tpd sulfuric acid plant. The basic engineering packages are:

- Specifications for piping materials

- Specifications for painting.

- A list of all the equipment required.

- Flow diagram creation and configuration finalisation.

- Diagrams of the sequence; process descriptions; single line diagrams; P&I diagrams; instrument lists, and so on.

Details about each individual component and process were also specified with accompanying documents, in addition to the core engineering packages, discussing important aspects of engineering design, such as:

- Structural and civil engineering.

- Materials for layout and piping (metallic and plastic).

- Static and rotary equipment.

- Instrumental and electrical engineering.

- Mechanical engineering.

- Erection and commissioning site supervision.

- As-built sketches.

Project management

Nuberg EPC’s project managers plan ahead to ensure that each phase is completed to meet the project’s success criteria while staying within its time frame. The following are some of the important critical pointers in project management processes:

- Ensuring compliance by closely monitoring important activities.

- The use of bar charts and the critical path method (CPM) to depict each project activity.

- During the thorough engineering phase, coordination with clients and providers is essential.

- Monitoring the procurement and delivery process.

- Monthly progress reports with comments on compliance and deviations are prepared.

Conclusion

Despite the effects of the COVID-19 pandemic decreasing demand for sulfuric acid, the global market is expected to grow in the near future due to rising demand for the product from sectors such as the fertilizer industry.

© This article was first published in World Fertilizer, May/June 2023.

Download PDF